What is the New Freelance Law? Explaining Key Points with Sample Contracts for New Law Compliance

With the enforcement of the “New Freelancer Law” in Reiwa 6 (2024) November, companies in Japan are now required to ensure strict compliance with legal regulations in their transactions with freelancers. The New Freelancer Law mandates transparency in transactions and appropriate contract content to create a secure working environment for sole proprietors. But how should companies respond to these requirements?

In this article, we will explain the key points of contracting with freelancers using sample contracts that comply with the New Freelancer Law.

Defining the Parties Subject to the New Freelance Law in Japan

The New Freelance Law, officially named the “Act on Ensuring the Proper Conduct of Specific Contractual Transactions Involving Specified Contractors,” has redefined freelancers as “Specified Contractors.”

This law applies to “contractual transactions” related to business consignment between specified business consignors and specified contractors. In other words, it targets business-to-business (B2B) transactions and does not apply to transactions between individuals and consumers.

Specified Contractors (Article 2, Paragraph 1)

A “Specified Contractor” refers to a business operator who is an individual not employing any employees or a corporation with only one representative and who accepts business consignment. Therefore, the New Freelance Law applies not only to individual freelancers but also to corporations that, apart from a single representative, have no officers or employees.

However, if “employees are employed,” the entity does not qualify as a “Specified Contractor.” The term “employees” does not include those who are temporarily employed for short hours or short periods.

Thus, “employing employees” means employing workers as defined in Article 9 of the Japanese Labor Standards Act, who are expected to work for more than 20 hours per week and are employed continuously for more than 31 days.

Furthermore, if a freelancer operates multiple businesses and employs employees in one of them, they are considered to be employing employees in all their businesses and do not qualify as “Specified Contractors.”

Specified Business Consignment Operators (Article 2, Paragraph 6)

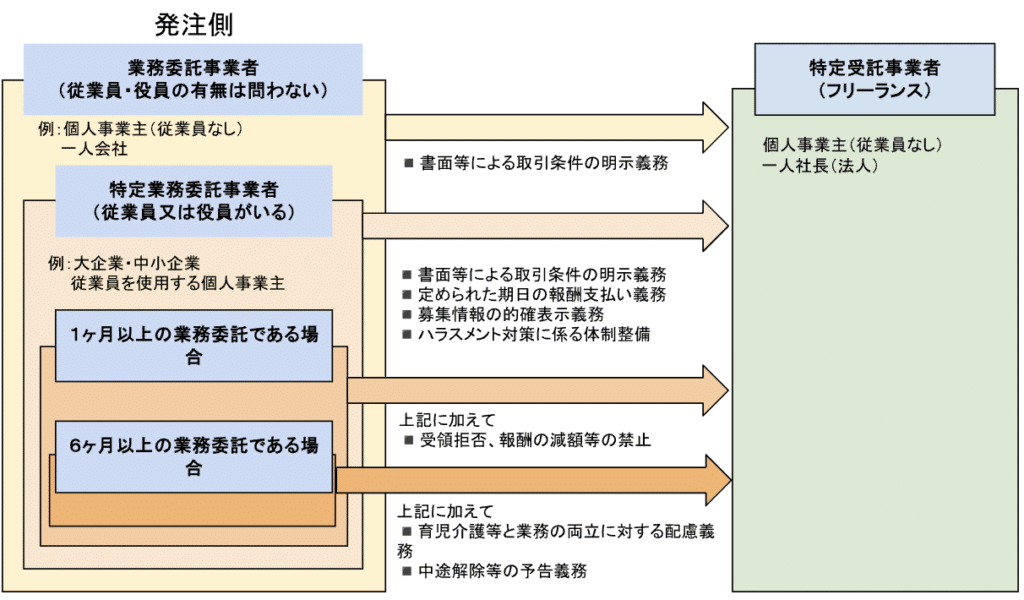

In the context of the New Freelance Law in Japan, let us first explain what a business consignment operator is. A business consignment operator is a business entity that consigns work to a specified contractor, regardless of whether it has employees or officers. Therefore, even sole proprietors and single-person corporations qualify as business consignment operators.

A “Specified Business Consignment Operator” refers to a business consignment operator that is either a sole proprietor employing employees or a corporation with two or more officers or employing employees. It can be said that many companies, from large corporations to small and medium-sized enterprises, fall under the category of Specified Business Consignment Operators.

Whether an entity is a business consignment operator or a Specified Business Consignment Operator makes a significant difference in the application of the regulations set forth by the New Freelance Law, which will be explained next.

Regulatory Content of the New Freelance Law in Japan

The new Japanese Freelance Law imposes various regulations on the client side to protect the rights of freelancers (specific contractors). When a business contractor commissions work to a specific contractor, regardless of the presence of the client’s employees or executives, the business contractor is obligated to explicitly state the transaction terms in writing or by electronic means (Article 3).

The regulations applicable to specific business contractors are as follows:

- Obligation to explicitly state transaction terms in writing or by electronic means (Article 3)

- Compliance with payment deadlines and prohibition of payment delays (Article 4)

- Obligation to accurately represent recruitment information (Article 12)

- Establishment of measures against harassment (Article 14)

Furthermore, when a specific business contractor commissions work to the same specific contractor for a period of one month or more, the following acts are prohibited (Article 5):

- Prohibition of refusal to accept work and reduction of remuneration

- Prohibition of providing unfair benefits

In addition, when entering into a contract for work commission with the same business entity for six months or more, the following obligations are added to the above (Article 16):

- Obligation to consider the balance between childcare and other responsibilities and work

- Obligation to provide notice in the event of mid-term cancellation or similar actions

Details of the New Freelance Law Regulations and Key Points for Contract Creation in Japan

So far, we have explained the overview of the regulations established by the new Freelance Law in Japan. Next, we will delve into the details of these regulations that govern companies and discuss the key points that businesses should be mindful of when drafting contracts, following the actual flow of contract creation.

Obligation to Accurately Display Recruitment Information (Article 12)

Under the new law, when providing information related to the recruitment of specific business contractors through advertisements or similar means, it is mandatory to ensure that the information is not falsely represented or misleading, and that it accurately and reflects the most current content.

It is important to note that “advertisements, etc.” include not only general publications but also electronic mails, and methods using messaging functions on social networks and similar platforms are also subject to this regulation.

Furthermore, “information” specifically refers to ① the content of the work, ② details regarding the location, duration, and hours of the work, ③ matters related to compensation, ④ matters concerning the termination or non-renewal of contracts, and ⑤ matters related to the person conducting the recruitment of the specific business contractors.

Examples of Necessary Changes in Descriptions

- Displaying a higher compensation amount than the actual payment to attract specific service providers intentionally (false representation).

- Recruiting under the name of a different company (such as the name of the original contracting business) than the actual company conducting the recruitment (false representation).

- Stating a contract period while actually concluding contracts for significantly different durations (false representation).

- In companies with related enterprises, making representations that could be confused with those related companies conducting the recruitment (misleading representation).

- Continuing to advertise with old information without deletion or modification, even after recruitment has ended or the content has been changed (outdated information display).

Today, it is common for companies to outsource the provision of recruitment information to other businesses. In such cases, it is important to request the termination or modification of the information from the advertising sources and to verify that the content has indeed been updated.

So, if a contract is concluded with different terms than those displayed at the time of recruitment (if the contract terms are changed at the time of contract conclusion), does this alone immediately constitute a violation of the obligation to display accurate information?

In conclusion, even if the terms of the actual contract differ from the content displayed at the time of recruitment, if they are based on an agreement between the company acting as a specific business contractor and the specific service provider, the recruitment display would not be considered a violation of the obligation to display accurate information.

Obligation to Explicitly State Transaction Terms in Writing (Article 3)

Under the new law, clients (on the corporate side) are required to clearly communicate transaction terms such as the nature of the work, compensation, and payment deadlines in writing before concluding a contract. Furthermore, this obligation is not limited to specific subcontractors, meaning it applies to all businesses contracting with freelancers.

When a business entrusts a specific subcontractor with a task, they must immediately disclose the details of the subcontractor’s deliverables, the amount of compensation, payment deadlines, and other matters in writing or by electronic means as prescribed by the Fair Trade Commission regulations.

Reference: Freelance Law Article 3, Paragraph 1

The items that must be explicitly stated in the contract are as follows:

- The trade name, personal name, or designation of the business contractor and the specific subcontractor, or a number, symbol, or other code that can identify the business contractor and the specific subcontractor

- The date on which the business was entrusted

- The content of the deliverables (services provided) by the specific subcontractor

- The date or other details when the deliverables are to be received or the services are to be provided

- The location where the deliverables are to be received or the services are to be provided

- If an inspection of the deliverables is to be conducted, the deadline for completing this inspection

- The amount of compensation

- The payment deadline

- Details to be specified if compensation is to be paid by means other than cash

These nine items must be explicitly stated “immediately” when entrusting the work. The interpretation guidelines of the Freelance New Law state that “immediately” means without any delay whatsoever.

Therefore, companies must agree with the specific subcontractor on the transaction terms to be explicitly stated not at the actual start of the entrusted work but at the stage of agreeing to entrust the work, and must disclose these terms.

However, the Freelance New Law also stipulates that “provided, however, that if there is a legitimate reason why the content of any of these items cannot be determined, such disclosure is not required. In this case, the business contractor must immediately disclose the said items in writing or by electronic means once the content of the undetermined items has been decided.”

Therefore, among the items to be disclosed, if there is a legitimate reason, such as an objective reason, why the content cannot be determined at the stage of contract conclusion due to the nature of the business subcontract, disclosure is not required.

Methods of Disclosure

Under the new law in Japan, service providers can disclose transaction terms to specific contractors through written or electronic methods (such as emails, SMS, or social media messages), and it is not always necessary to formalize the terms in a contract document (Article 3, Paragraph 2).

However, if a specific contractor requests a written document, the service provider must provide it without delay, unless doing so would not hinder the protection of the specific contractor.

Circumstances that would not hinder the protection of the specific contractor include the following:

- When the service provider has made the disclosure in response to a request for electronic provision from the specific contractor.

- When the service contract, which includes standard terms created by the service provider, is concluded solely through the use of the internet, and these standard terms are made available online for the specific contractor to view.

- When a written document has already been provided.

Key Points for Companies to Note Under Japanese Law

To avoid disputes arising from violations of disclosure obligations, it is advisable to keep a record when providing information in writing or similar means, ensuring that the fact of provision can be verified later.

Furthermore, when making disclosures electronically, it is necessary to save the disclosed content to prevent its loss.

Obligation to Pay Remuneration Within 60 Days (Article 4)

The prevention of payment delays is also emphasized under the new law for freelancers in Japan.

Regardless of whether an inspection of the services provided is conducted, there is a mandated obligation to set a payment deadline within 60 days from the day the services of a specific contractor are received and to make the payment by this deadline.

Furthermore, if a payment deadline is not established, the day the services are received will be considered the payment deadline. If the payment deadline is set beyond 60 days from the day the services are received, the day before the 60th day from the day the services are received will be deemed the payment deadline (Article 4, Paragraph 2).

Exceptions in the Case of Subcontracting

As previously explained, the payment deadline for remuneration under the Freelance Law in Japan is set within 60 days as a general rule.

However, there is an exception for cases where a business task received from another client (the original contractor) is subcontracted to a specific subcontractor. In such cases, provided that ① the fact that it is a subcontract, ② the trade name, personal name, or designation of the original contractor, or a number, symbol, or other code that can identify the original contractor, and ③ the payment deadline for the consideration of the original contracted task are clearly indicated, payment can be made within 30 days from the payment by the original contractor.

Obligation to Establish a System for Harassment Measures by Companies Under Japanese Law (Article 14)

Specific business contractors are obligated to take necessary measures, including the establishment of a consultation system, to prevent harassment from harming the working environment of specific contract workers (Paragraph 1). Furthermore, specific business contractors must not treat specific contract workers unfavorably for reasons such as having consulted about harassment (Paragraph 2).

The necessary measures refer to actions such as the following, and companies are required to respond promptly:

- Clarification and dissemination of policies stating that harassment is prohibited

- Prompt and appropriate response to harassment in business contracting

- Establishment of a system necessary to respond appropriately to consultations

Prohibited Actions by Businesses Under Japanese Law (Article 5)

Unfair practices against freelancers are also regulated under the new law in Japan. Companies must not reduce or refuse payment without a reasonable cause, and harassment or unfair demands are also prohibited.

Refusal to Accept Delivery Without Just Cause (Article 1, Paragraph 1, Item 1) Under Japanese Law

In Japan, companies that are clients are prohibited from refusing to accept delivery of services when there is no fault attributable to the specific contractor. This means that the client cannot reject the delivery if the contractor is not to blame.

Reasons that could be attributed to the contractor’s fault include cases where the content of the delivery does not match the commissioned work, or when the delivery is not made by the deadline, rendering the delivery unnecessary. However, if such circumstances arise due to the unilateral convenience of the client, refusing to accept the delivery under these conditions would be considered an unjustified refusal, and caution is required.

Unjust Reduction of Remuneration (Article 1, Paragraph 2)

Even if there is a prior agreement, it is prohibited to reduce the amount of remuneration established at the time of commissioning the work, unless there are reasons attributable to the fault of the specific contractor.

Reasons attributable to the fault of the contractor are concretely defined in the guidelines as follows:

- In cases where it is not a violation of the Freelance Law to refuse acceptance or to return the work due to reasons attributable to the contractor, reducing the amount of remuneration related to the benefit when refusing acceptance or making a return

- When the client makes corrections themselves, reducing the remuneration by an amount deemed objectively reasonable for the costs incurred for the corrections

- In cases where it is not a violation of the Freelance Law to refuse acceptance or to return the work due to reasons attributable to the contractor, and when the decrease in the value of the goods is evident, reducing the remuneration by an amount deemed objectively reasonable

Prohibited Unreasonable Returns (Article 1, Paragraph 3, Item 3)

It is prohibited to demand the return of goods related to a service received without any fault attributable to the specific contractor after the service has been provided.

Examples of situations where there is no fault attributable include the following:

- Returning the product of a service to a freelancer simply because a client who purchased the service outcome has returned it.

- Returning the product of a service to a freelancer due to defects that could have been immediately discovered, yet claiming the defects only after a standard inspection period for the service outcome has significantly elapsed.

Regardless of whether an inspection has been conducted, once the goods are factually under the control of the specific service contractor, it is considered received, and thereafter, issues such as ‘returns’ may arise, which requires attention.

Setting Unfairly Low Remuneration Compared to Market Rates (Article 1, Paragraph 4)

It is prohibited to set a significantly lower amount of remuneration for the services provided by a specific contractor compared to the usual compensation for similar or identical services.

To determine whether this constitutes an unfair lowballing of prices, several factors are considered comprehensively: (1) the method of determining the compensation, (2) whether the determination of compensation is discriminatory, (3) the discrepancy between the “usual compensation” and the actual compensation paid, and (4) the price trends of raw materials and other elements necessary for the provision of services.

Prohibition of Forced Purchases or Service Usage by Companies (Article 1, Paragraph 5)

The new law prohibits specific contractors from being forced to purchase goods or use services designated by a company unless it is necessary to standardize the benefits or improve them, or unless there is no other legitimate reason for such coercion.

In addition, when a company enters into a business outsourcing contract with a specific contractor for a period of one month or more, the following actions are also prohibited in addition to the aforementioned prohibited conduct.

Requests for Unjust Economic Benefits (Article 2, Item 1)

Under Japanese law, it is prohibited for a company to request from a specific contractor the burden of cooperation fees, the provision of services without compensation, or any other provision of economic benefits without a legitimate reason, especially if the contractor feels compelled to accept due to concerns about the impact on future transactions. Such requests are considered to unfairly disadvantage the contractor in light of normal business practices.

For example, the guidelines envision scenarios where a company might request a freelancer to participate in sales activities for its own clients, unrelated to the contracted services and without any connection to the order content, and to do so without compensation. Another scenario includes demanding sponsorship fees for financial statement measures and imposing this burden on the freelancer.

Reference: Guidelines for Creating a Safe Working Environment for Freelancers

Unilateral Changes to the Scope of Work That Are Not Attributable to the Service Provider (Article 2, Paragraph 2)

The new law prohibits the unilateral alteration of the scope of services provided by a specific contractor, as well as requiring the contractor to redo the services after they have been received or after the provision of services, even when there is no discrepancy between the services provided and the contract terms.

Unjust changes to the scope of services and unfair demands for redoing work also include the unilateral cancellation of orders without bearing the costs incurred by the specific contractor in performing the work.

Obligations for Companies to Establish a Working Environment for Freelancers in Japan

When a company enters into a contract with a specific contractor for a period of six months or more, it becomes obligated to establish a proper working environment.

Duty to Consider Work-Life Balance for Childcare and Caregiving (Article 13)

Under Japanese law, companies must provide necessary considerations to ensure that specific contractors can balance childcare, caregiving, and their work if a request is made for contracts lasting six months or more.

Specific contracting businesses must understand the content of the request from the specific contractor, consider what considerations are necessary, and implement them. If it is unavoidably impossible to provide these considerations, they must explain the reasons to the specific contractor, which requires careful attention.

Duty to Notify in Advance and Disclose Reasons for Mid-Term Termination or Non-Renewal of Contracts (Article 16)

Specific contracting businesses in Japan are required to notify the specific contractor at least 30 days in advance if they decide to terminate or not renew a contract related to a business commission lasting six months or more.

Furthermore, if the specific contractor requests the disclosure of the reasons for the mid-term termination or non-renewal, the specific contracting business has the obligation to disclose these reasons.

Responding to Violations of the New Freelance Law in Japan

When a company violates the regulations of Japan’s New Freelance Law, various sanctions can be imposed by government agencies.

If a report of a violation is filed, agencies such as the Fair Trade Commission and the Small and Medium Enterprise Agency will conduct necessary investigations (collecting reports and conducting inspections) to verify whether the claims are factual. If the claims are determined to be true, in addition to providing advice and guidance, they will issue recommendations. If the recommendations are not followed, they may proceed to publicize the violation and issue orders.

Furthermore, a fine of up to 500,000 yen may be imposed for non-compliance with orders or non-cooperation with investigations. The same penalties apply to corporations.

Reference: Fair Trade Commission Special Site on the Freelance Law (2024)

Summary: Consult an Attorney for Compliance with the New Freelancer Law in Japan

Thus far, we have explained the regulatory content of the new Freelancer Law in Japan and the points to be cautious about in contracts.

With the enforcement of the new Freelancer Law, protection for freelancers has been enhanced. On the other hand, companies are now required to create appropriate contracts and design internal systems. Failure to comply may result in severe sanctions, including fines and public disclosure.

In today’s environment, where corporate evaluations are directly linked to company value, it is advisable to seek professional advice from an attorney to avoid reputational risks associated with public disclosures due to non-compliance.

Guidance on Measures by Our Firm

Monolith Law Office is a law firm with high expertise in both IT, particularly the internet, and legal matters. In complying with the Freelancer’s New Law in Japan, there are times when the creation of contracts becomes necessary. Our firm provides contract drafting and review services for a wide range of cases, from Tokyo Stock Exchange Prime-listed companies to venture businesses. If you are having trouble with contracts, please refer to the following article.

Areas of practice at Monolith Law Office: Contract Drafting & Review, etc.