Key Points of the Major Revision of the 'Employment Insurance Act' Enacted in April of Reiwa 7 (2025) and Its Impact on Businesses

Starting April 2025 (Reiwa 7), the amended “Employment Insurance Act” will be enforced, significantly transforming the Japanese Employment Insurance System.

Due to the necessity for a system that aligns with the socio-economic reality, various measures have been adopted with the aim of constructing an employment safety net that effectively supports diverse work styles and enhancing investment in people.

This article will explain the key points of the revisions to the “Employment Insurance Act” and their impact on businesses in Japan.

Overview of the Japanese Employment Insurance System

The Japanese Employment Insurance System, as defined by the Employment Insurance Act, serves two main purposes.

Firstly,

- It provides necessary benefits when a worker becomes unemployed or when it becomes difficult for a worker to continue employment due to certain circumstances,

- When a worker undergoes vocational education and training on their own initiative,

- When a worker takes leave to care for a child,

by offering “unemployment benefits” and “childcare leave benefits” to support the livelihood and employment stability of workers and to promote re-employment.

Secondly,

- Prevention of unemployment,

- Correction of employment conditions and increase of employment opportunities,

- Development and enhancement of workers’ skills and other measures to improve workers’ welfare,

it operates as a comprehensive system with employment-related functions, conducting two projects (employment stability and skill development) with these objectives in mind (Article 1 of the Act).

“Unemployment benefits,” specifically, refer to four types of benefit systems: jobseeker’s benefits (unemployment basic allowance), employment promotion benefits (employment allowance, re-employment allowance, employment promotion stability allowance), employment continuation benefits (older employment continuation benefits, caregiving leave benefits), and education and training benefits (please refer to the table below for the burden-sharing ratio).

The Employment Insurance Act is the law that established the Employment Insurance System in 1947, and it is one of the four laws related to the “Act on Partial Revision of the Employment Insurance Act and Other Acts” enacted in May 2024 (Reiwa 6).

Key Points of the Amended Employment Insurance Act Enforced in April 2021 (Reiwa 7)

The “Act Partially Amending the Employment Insurance Act and Other Related Acts” was enacted with the aim of constructing an employment safety net suitable for the socio-economic reality and enhancing investment in people. This was done by introducing a package of various measures to effectively support diverse working styles.

Consequently, a significant amendment has been made to the Employment Insurance Act in Japan, expanding the coverage of employment insurance.

Expansion of Eligibility for Employment Insurance in Japan

Amendments have expanded the scope of individuals eligible for employment insurance by changing the required weekly working hours from “20 hours or more” to “10 hours or more.”

This requirement will come into effect in October of Reiwa 10 (2028).

Enhancing Education, Training, and Reskilling Support

Investments in people (human resource development) have led to the following changes and creations:

- Shortening the benefit restriction period for voluntary resignees from two months to one month

- However, if individuals voluntarily undertake necessary vocational education and training for employment stability and job promotion, they can receive the basic allowance of employment insurance without any benefit restriction

- Establishing a system that provides an additional 10% (up to 50,000 yen annually) of educational training expenses for those who complete “Specific General Education Training,” acquire a qualification, and find employment within a year (increasing the subsidy rate from 40% to 50%)

- For those who complete “Professional Practical Education Training,” acquire a qualification, and find employment within a year, an additional 20% (up to 160,000 yen annually) of educational training expenses was already provided. A new system will now offer an additional 10% (up to 80,000 yen annually) if the wage after completing the training increases by at least 5% compared to the wage before starting the training (raising the subsidy rate from 70% to 80%)

- Creating a new “Educational Training Leave Benefit” equivalent to the basic allowance as life support for insured individuals who voluntarily take leave for educational training while employed (for a period of one month to one year, extendable by four years under ministerial ordinance for specific reasons)

Ensuring Stable Financial Management for Childcare Leave Benefits in Japan

Changes have been made to the childcare leave benefits system in Japan as follows:

- The temporary measure reducing the government’s share of childcare leave benefits from one-eighth to one-eightieth has been abolished.

- The insurance premium rate for childcare leave benefits will be increased from 0.4% to 0.5%, with the flexibility to reduce it back to 0.4% depending on the financial status of the insurance system.

(Due to items 1 and 2, the insurance premium rate will be maintained at the current 0.4% for the time being, with flexible adjustments based on the financial status of the insurance system.)

- Establishment of a special account for child and child-rearing support.

- Creation of “Post-Birth Leave Support Benefits” (13% of the daily wage at the start of leave, with a cap that combines with the childcare leave benefit to a maximum of 80%), and “Childcare Short-Time Work Benefits” (10% of the daily wage during reduced working hours for childcare).

Revisions to Other Employment Insurance Systems in Japan

In addition, the following temporary measures will be continued until the end of fiscal year 2023 (Reiwa 8).

- Temporary reduction in the benefit rate for the Education and Training Support Benefit (providing an amount equivalent to the basic allowance after unemployment benefits end for job seekers under 45 years old) from 80% to 60% of the basic allowance

- Temporary reduction in the government’s burden for caregiving leave benefits from one-eighth to one-eightieth

- As a special case for specific benefit-eligible individuals and those who leave their jobs for specific reasons, the temporary measure of regional extension benefits (extending the number of benefit days in designated areas with insufficient employment opportunities)

The following systems will be changed or abolished:

- The employment promotion allowance (employment allowance, re-employment allowance, and employment promotion settlement allowance), among which the employment allowance paid to short-term workers will be abolished, and the benefit rate for the employment promotion settlement allowance will be reduced (from 40-30% of the remaining days of basic allowance to a uniform 20%)

- Reduction in the benefit rate for the Continued Employment Benefits for Older Workers (from 15% to 10% of the daily wage amount at the time of reaching 60 years old)

The Impact of Amendments to the Employment Insurance Act on Companies in Japan

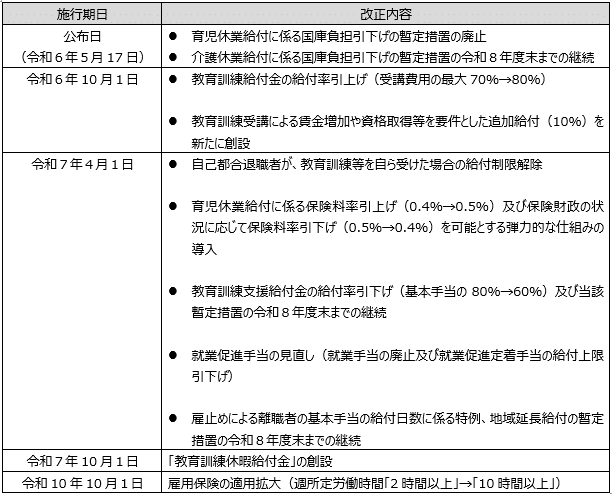

The implementation dates of a series of amendments to the Japanese Employment Insurance system can be summarized in the following table.

Employers need to assess the impact, including both advantages and disadvantages, and consider their response accordingly.

Source: Ministry of Health, Labour and Welfare, “About the Enactment of the Law Partially Amending the Employment Insurance Act[ja]”

The expansion of the scope of employment insurance in Japan has disadvantages for employers, such as an increase in the amount of employment insurance contributions and more complicated procedures.

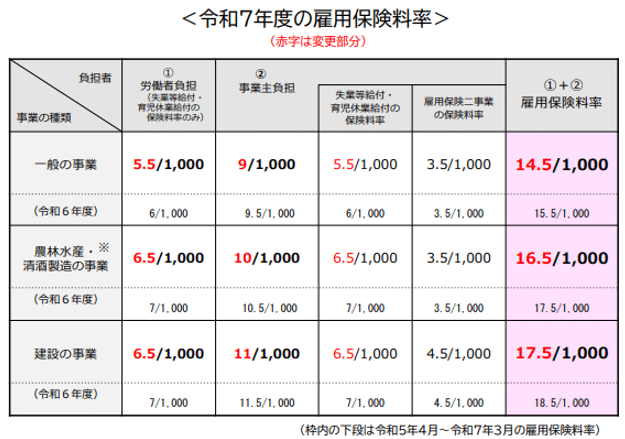

The contribution rates for the fiscal year 2025 are as follows.

Source: Ministry of Health, Labour and Welfare, “Employment Insurance Premium Rates for Fiscal Year 2025 (Reiwa 7)[ja]”

- The reduction in the Employment Training Support Benefit may burden job seekers, making it more difficult to receive training. This could lead to a decrease in their motivation to work, complicating talent acquisition, and potentially affecting productivity even after employment. If employee skill development does not progress, a company’s competitiveness may also decline. Companies need to consider new measures to support the skill development of their employees.

- The strengthening of the financial foundation for voluntary resignees could lead to an increased risk of talent outflow and intensified competition in the labor market. Considering these impacts, companies need to develop appropriate human resource strategies.

- With the financial foundation for voluntary resignees being strengthened and the planned increase in the insurance premium rate for childcare leave benefits, both employers and employees may face higher employment insurance contributions.

In light of these impacts from the amendments, companies must consider introducing an “Educational Training Leave System,” changing employment regulations, ensuring thorough communication with employees, enhancing employment insurance procedures and career development support for workers, and establishing a system for talent management and re-employment support.

Additionally, companies need to strengthen their financial base in preparation for the increased burden of employment insurance.

Reference: Subcommittee on Employment Stability, Employment Insurance Committee, “About the Enactment of the Law Partially Amending the Employment Insurance Act[ja]”

,

Conclusion: Consult a Lawyer for Adaptation to the Amendments of the Japanese Employment Insurance System

The recent amendments to the Japanese Employment Insurance Act could have a significant impact on corporate human resources and labor management. It may be necessary to review and revise related regulations such as work rules and wage systems.

If you feel uncertain about how to respond to the legal amendments, we recommend consulting with a lawyer who is an expert in the field. By receiving tailored advice and support for the necessary regulation adjustments that fit your company’s situation, you can confidently address the changes brought about by the legal amendments.

Guidance on Measures by Our Firm

Monolith Law Office is a law firm with high expertise in both IT, particularly internet law, and legal matters. Our firm provides support in human resources and labor management for a wide range of clients, from Tokyo Stock Exchange Prime-listed companies to venture businesses, and handles the creation and review of contracts for various cases. For more details, please refer to the article below.

Areas of Practice at Monolith Law Office: Corporate Legal Services for IT & Startups

Category: General Corporate

Tag: General CorporateIPO