Growing Focus on Family Governance for Executives: Explaining the Effectiveness in Business by Category

It is not uncommon to hear reports of family disputes within well-known family-run businesses. When such reports surface, many may have come across the term ‘Family Governance.’ ‘Family’ refers to the household, and ‘Governance’ to governance or control. While the direct translation is ‘family governance,’ what does this concept actually entail?

Knowledge of Family Governance is essential for entrepreneurs who have built substantial assets. However, there are those who may not fully understand what this system is and the significance it holds.

In this article, we will explain the basics of Family Governance and discuss the importance of establishing it for business owners. We will delve into the benefits that Family Governance can bring to the management of a company, providing a detailed analysis that will serve as a valuable resource for our readers.

What is Family Governance Necessary for Business Owners?

Since there is no legal definition or regulation for family governance, many may find it difficult to understand. Here, we will explain the overview to comprehend the significance of family governance.

Overview of Family Governance

Family governance refers to the governance structure within a family or relatives. It is often used in the context of governance rules in family businesses where relatives are involved in management.

An important function of family governance is to coordinate differences of opinion and interests within the family.

In other words, the use of family governance is not limited to the business context. It has significance in designing and operating as a broader family community. Family governance is established not only to determine what is necessary for business but also to shape the overall happiness of the family.

However, this article will explain family governance in the ‘business context’.

The Relationship with Corporate Governance

Corporate governance is a system for establishing a management and supervision structure for the sound management of a company. It has become important in corporate management as an indispensable system for companies to fulfill their social responsibilities.

In family businesses, it is necessary to balance both the corporate governance required for ordinary companies and family governance. This balance is not just a side-by-side relationship; a dual structure emerges where corporate governance exists based on the family business.

This is because, in family businesses, the quality of the family’s governance system is directly linked to business performance. In family businesses, the robust construction of both family governance and corporate governance is required.

Three Reasons Why Business Owners Should Establish Family Governance

There are significant benefits for business owners in establishing family governance.

Here, we will explain the reasons why business owners should build family governance.

Unique Risks of Family Businesses

In family businesses, where family members or relatives are involved in management, unique issues arise that are not found in typical companies. It is common for family disputes or inheritance issues to directly impact the business. To avoid these risks, it is essential to establish family governance.

Typical risks faced by families running a family business include:

- Minority shareholder management

- Outflow of family assets

- Divorce and property division

- Successor dropout

- Claims for infringement of reserved portion

- Privacy violations

While family businesses have the strength of being based on the close relationship of the ‘family,’ conflicts among family members can evolve into business risks.

In family governance, it is important to establish governance rules in advance to address these risks.

Preserve and Defend Assets

Designing family governance to avoid the unique risks of family businesses also leads to the preservation and defense of the family’s assets. Constructing family governance is meaningful in protecting current assets and developing them for the next generation of the family.

Maintaining family governance to avoid risks that could harm business and family assets is crucial for the continuity of the business.

Multiple Stakeholders

One reason why business owners should establish family governance is the inherent complexity of family businesses.

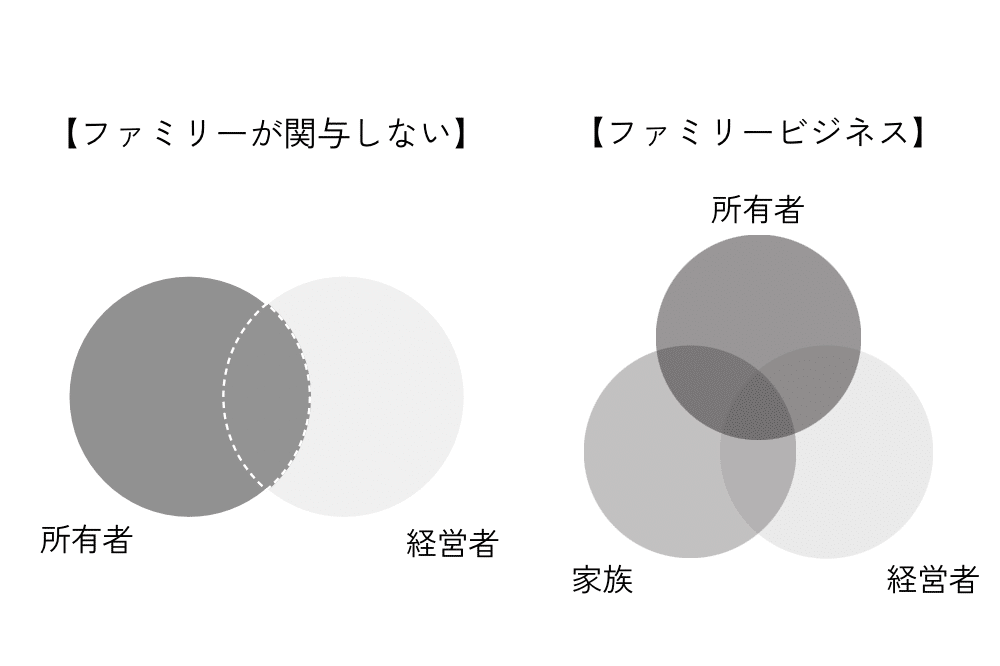

In businesses not involving family, typically only ‘owners’ and ‘managers’ are involved in corporate management. Under the corporate system, these two areas can be completely separate.

However, in family businesses, a unique domain of ‘family’ emerges.

With the increase in stakeholders, the adjustment of interests in management becomes significantly more challenging. Family governance holds great significance in organizing these complex management considerations.

Considerations for Stakeholders in Family Businesses

In family businesses, a more complex set of interests often arises compared to standard corporate management. Here, we will explain the types of stakeholders that should be considered in family businesses.

About the Three-Circle Model

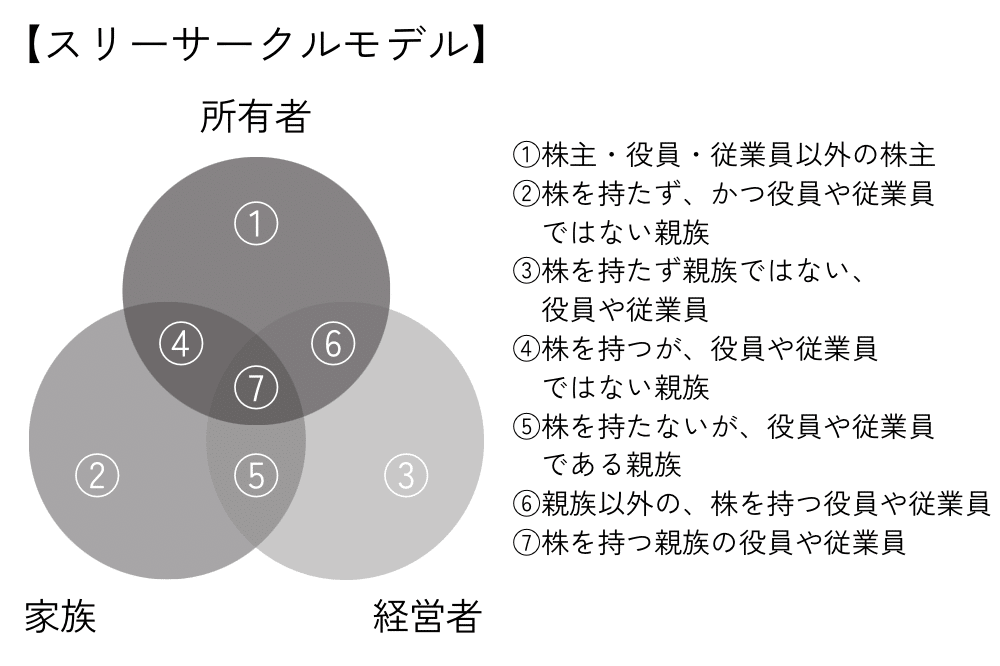

In family businesses, there are three roles involved in management as depicted in the following diagram: ‘owners,’ ‘managers,’ and ‘family.’

This diagram, where the three areas overlap, is known as the ‘Three-Circle Model’ and represents the key considerations in a family business.

When the family’s influence on the business is strong, the overlapping areas become even larger. In such cases, it becomes necessary to more closely coordinate the increasingly complex interests.

Furthermore, as the business expands and time progresses, the size of these three areas fluctuates. As the business develops and the number of stakeholders continues to grow, it is essential to adjust the understanding of the factors to consider in accordance with the changing circumstances.

Shareholders

In the realm of family business ownership, that is, shareholders, we can consider the existence of the following four patterns of individuals:

- Shareholders who are neither family members, officers, nor employees (1)

- Family members who hold shares but are not officers or employees (4)

- Officers or employees who hold shares but are not family members (6)

- Officers or employees who are family members and hold shares (7)

Those who belong to area 1 in the Three Circle Model are individuals who hold shares but are neither part of the family nor involved in the business. They possess voting rights at the shareholders’ meeting, which can influence management decisions. Therefore, just like in a typical corporation, the interests of these shareholders must always be considered in company management.

Furthermore, those who belong to area 7 in the Three Circle Model possess all the personalityistics of being shareholders, family members, and officers or employees. A prime example of this is the ‘owner-president.’

Individuals in the shareholder domain have various rights depending on the number of voting rights and shares they hold. When constructing governance, it is essential to consider the rights of shareholders within the company and to design adjustments to the voting rights ratio, as well as the creation of preferred shares and shareholder agreements.

Business Leaders

In the realm of family business management, there are four patterns of individuals:

- Non-family officers and employees who do not hold shares (3)

- Family members who are officers or employees but do not hold shares (5)

- Non-family officers and employees who hold shares (6)

- Family member officers and employees who hold shares (7)

Those who fall into area 3 of the Three-Circle Model are what we call the typical officers and employees. The company’s management relies on the support of these individuals.

It is crucial for these general officers and employees to understand the unique risks and values inherent to the family business.

Furthermore, with family members in area 5, the manner of their involvement in the business and employment becomes an issue.

If someone who does not align with the family’s values becomes involved in management, it could lead to reckless business decisions or the privatization of company assets. This can also cause friction with other family members and officers, necessitating measures to isolate such family members from the family business if needed.

Moreover, when employing a family member, it is essential to be aware that family ethics may not apply under the force of laws such as the Japanese Labor Standards Act. To prevent family issues from escalating into labor disputes, it is necessary to establish rules in advance.

Family & Relatives

In the realm of family businesses, there are four main patterns of involvement for family members:

- Relatives who neither hold shares nor serve as officers or employees (2)

- Relatives who hold shares but are not officers or employees (4)

- Relatives who do not hold shares but are officers or employees (5)

- Relatives who are officers or employees and hold shares (7)

Relatives in category 2 of the Three-Circle Model are those who neither hold shares nor serve as officers or employees. They may seem uninvolved in the business or ownership, and at first glance, it might appear that there are no interests to align. However, these family members should also be considered in family governance.

Even if they are not directly involved in management, family members can be a source of emotional and financial support for the entrepreneur. Their opinions and values may influence business operations in some way.

Furthermore, unique legal issues can arise within the family, even if they are not involved in management:

- Property division

- Adoption

- Inheritance

- Reserved portion issues

Such issues are not resolved solely within the family domain; they significantly impact ownership and business. It is crucial for entrepreneurs to establish a governance structure through family governance that includes relatives who are not involved in management.

Key Points in Aligning Interests through Family Governance

As the Three-Circle Model illustrates, family businesses involve many different positions, each with its own set of interests to align. Here, we will explain the key points of interest alignment that come into play when constructing family governance.

Within the Realm of Family Relations

In family governance, we coordinate the interests within the realm of family relations, including matters that may not seem directly related to business. Making necessary adjustments to ensure happiness and fulfillment within the family is beneficial for all activities, both public and private. It is crucial to consider the specific circumstances of each family when making these adjustments.

The main points that typically require coordination include:

- Approaches to work and money management

- Values regarding household chores, child-rearing, and education

- Asset division during divorce

- Management and operation of private assets

- Methods for transferring and inheriting private assets

When it comes to the involvement of family members in the business realm, careful consideration must be given to whether they should be involved at all, and if so, how to manage the governance risks associated with their involvement.

Furthermore, it is essential to manage and operate private assets, separate from business-related assets, in a way that prevents dissipation, reduction, or damage, and to ensure their transfer to the next generation. While considering legal issues such as inheritance tax and the will of the successor, it is necessary to take measures that anticipate risks.

Within the Domain of Ownership Relations

Owning and managing a company requires various adjustments within its domain.

When a change in management occurs, stakeholder relationships also shift. Amidst these changes, maintaining and inheriting the company’s philosophy, organizational transformation, and successor development are among the many challenges that must be addressed.

To ensure the company’s continuity as envisioned, it is crucial to establish a business succession plan that takes into account risks such as:

- Business continuity risk

- Risk of disputes among heirs

- Taxation risk

Formulating a basic policy requires consideration of a wide range of issues.

Furthermore, from the perspective of ownership, it is essential to consider shareholder agreements and the use of class shares and articles of incorporation. To prevent the dispersion of shares with each succession, it is vital to establish clear rules for share handling.

Moreover, it is important to understand that preventing risks through family governance also protects the intangible assets formed by the family, such as connections and reputation.

Within the Business Relations Sphere

In the context of employment relationships with stakeholders, special attention is necessary for family businesses. When employing family members, it is crucial to establish forms of involvement and employment conditions prepared for labor disputes. Since labor contracts cannot be easily terminated due to the protections of the Japanese Labor Law, it is important to consider the potential breakdown of harmonious family relationships.

Furthermore, gaining understanding from non-family staff members about working in a family-owned enterprise is also a vital measure. If family values and issues are imposed, there is a risk that talented staff may resign. Engaging in communication, sharing the company’s philosophy and vision, as well as the founding family’s sentiments and roots, holds significant value.

Conclusion: Consult a Lawyer for Family Governance Concerns

Family governance plays a crucial role in avoiding the unique risks of family businesses and in preserving and passing on accumulated assets. Family businesses are personalityized by having a larger number of stakeholders compared to regular businesses, making it challenging to align their varying interests. Organizing these complex interests and considering family-specific issues in advance is essential for business owners to operate with peace of mind.

However, establishing family governance involves a wide range of considerations. Not only is a system tailored to the current state of the company required, but also the flexibility to transform the system as circumstances change. Therefore, we recommend seeking legal and objective advice from a lawyer when constructing your family governance.

For specific information on designing, building, and managing family governance, please refer to this.

Related Article: What Should Business Owners Design in Family Governance? Detailed Explanation of Construction and Management Methods[ja]

Guidance on Measures by Our Firm

Monolith Law Office is a law firm with high expertise in both IT, particularly the internet, and legal matters. In advancing family governance, there are times when the creation of contracts becomes necessary. Our firm provides contract creation and review services for a wide range of cases, from Japanese Tokyo Stock Exchange Prime-listed companies to venture businesses. If you are having trouble with contracts, please refer to the article below.

Areas of practice at Monolith Law Office: Contract Creation & Review, etc.[ja]

Category: General Corporate

Tag: General CorporateIPO

![[April 2023] Is](https://monolith.law/en/wp-content/uploads/sites/6/2026/01/d494fad4d22a3566d524b84f632bae33.webp)