Why are Excessive Cashback Campaigns (Point Return) Illegal?

Smartphone payment services such as LINE Pay and PayPay, as well as cashless payment services like credit cards, often run limited-time cashback (point return) campaigns. However, if not careful, these campaigns could potentially become illegal.

In this article, we will explain the circumstances under which cashback or point return campaigns can become illegal, aimed at businesses considering such campaigns.

What Percentage of Cashback (Point Return) Becomes Illegal?

Cashback (point return) campaigns can potentially be subject to the regulations of the Japanese Premiums and Representations Act.

What is the Premiums and Representations Act?

The Japanese Premiums and Representations Act (Act against Unjustifiable Premiums and Misleading Representations) aims to protect consumer interests by prohibiting misleading representations and restricting or prohibiting premiums. In other words, it prevents consumers from being swayed by misleading representations or excessive premiums, which could lead them to choose inferior products or services.

For instance, under the Premiums and Representations Act, if a slogan such as “Half off the regular price!” is too aggressive, it could be subject to legal regulation as a dual pricing display.

Are Point Returns Subject to the Premiums and Representations Act?

The guidelines of the Premiums and Representations Act specify the types of points that can be regulated. Points from services like LINE Pay or Pay Pay fall under the category of “points that can only be used for part of the payment & can be used in other stores,” and are therefore subject to the regulations of the Premiums and Representations Act.

Points that can be exchanged for premiums or cash gifts ⇒ Regulated

Points that can only be used for part of the payment & can be used in other stores ⇒ Regulated

Points that can only be used for part of the payment & can only be used in the same store ⇒ Not regulated as they are considered discounts

Premiums and Representations Act Guidelines

Maximum Percentage Defined by the Premiums and Representations Act

The cashback (point return) campaigns offered to service users fall under the category of “total premiums,” and the maximum amount of total premiums is as follows:

Maximum Amount of Total Premiums

| Transaction Amount | Maximum Amount of Premiums |

| Less than 1,000 yen | 200 yen |

| 1,000 yen or more | One-fifth of the transaction amount |

If the transaction amount is 1,000 yen or more, the maximum amount of point return is 20% of the transaction amount. The point return campaigns conducted by LINE Pay and PayPay were set at a return rate of 20% in accordance with this maximum amount.

Maximum Amount of Premiums in General Lotteries

Furthermore, LINE Pay’s “Lucky Draw” and “Max 20 Times Money Transfer Campaign,” as well as PayPay’s “Lucky Draw That Wins a Lot,” fall under the category of “general lotteries.”

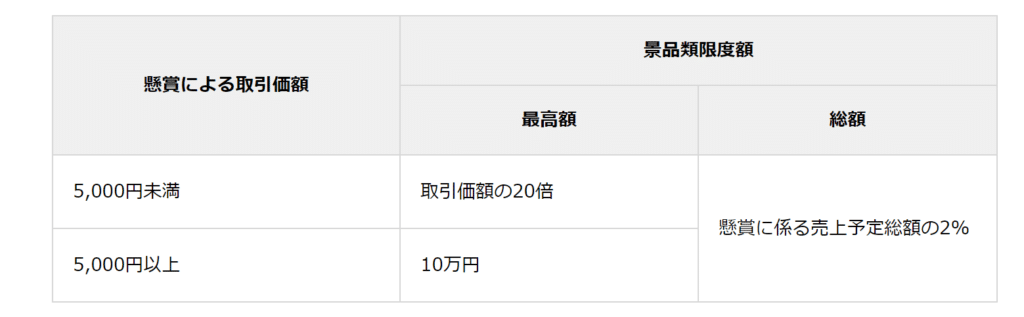

Under the Premiums and Representations Act, the maximum amount of premiums in general lotteries is defined as follows. It is believed that the maximum amount for LINE Pay’s “Max 20 Times Money Transfer Campaign” and PayPay’s “Lucky Draw That Wins a Lot” was set at 100,000 yen based on the following regulations.

Furthermore, this topic is somewhat related to the “prize money” associated with products (such as games) released by companies, such as in e-sports tournaments.

Examples of Cashback (Point Return) Campaigns Violating the Japanese Premiums and Representations Act

In March 2020 (Heisei 32), the Consumer Affairs Agency issued an order to AEON Bank for violating the Japanese Premiums and Representations Act in relation to the display of services for their credit or debit cards. The campaign in question was the “(New Members Only) Up to 20% Cashback Campaign”.

In this campaign, it was displayed that if you newly joined the credit card during the membership period and applied for the campaign, and used the card during the usage period, you could receive a cashback of up to 20% of the corresponding amount, with a maximum cashback amount of 100,000 yen. In reality, there were exceptions stated, and there were cases where cashback could not be received.

The Consumer Affairs Agency ordered:

“To thoroughly inform the general consumers that the display, which could be misunderstood by the trading partner as being significantly more advantageous than the actual trading conditions, violates the Japanese Premiums and Representations Act”, “To take measures to prevent recurrence and thoroughly inform this to officers and employees”, “Not to make similar displays in the future”

.

About the order based on the Japanese Premiums and Representations Act against AEON Bank Co., Ltd.

In this case, there was no problem with the percentage of cashback, but it was problematic that there were exceptions and there were cases where cashback could not be received.

Summary: Considering Cashback Campaigns under Japanese Premiums and Representations Act

When planning a cashback (point return) campaign, it is necessary to carefully consider whether the points constitute a “prize” under the Japanese Premiums and Representations Act, and how the method of returning points is classified under “prizes”. The maximum amount and other conditions may vary depending on these factors.

Furthermore, it is crucial to avoid expressions that may mislead consumers. There are areas where judgment can be difficult, so if you are unsure, it is recommended to consult with a lawyer who handles many cases related to the Japanese Premiums and Representations Act.

Category: General Corporate

Tag: General CorporateIPO